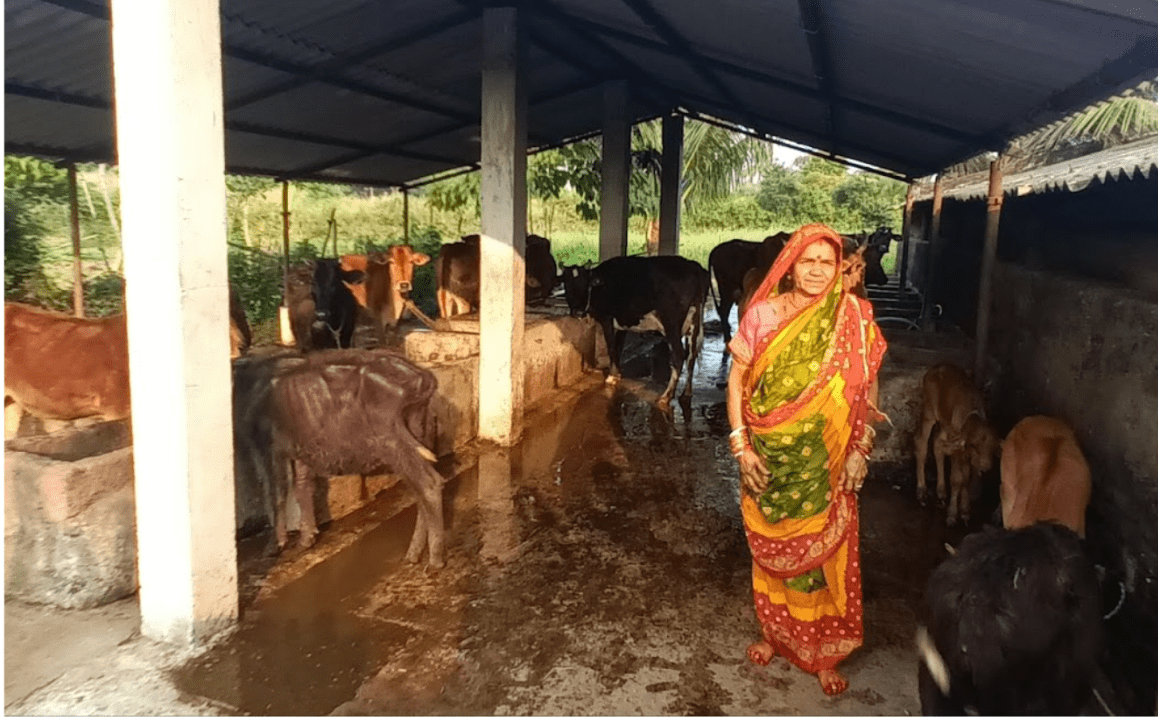

Suresh is a progressive farmer in the Balangir district of Odisha. Apart from the paddy cultivation, he also owns a herd of 8 milk-producing cows. He earns a significant portion of his income by selling milk daily to the milk pouring centre of OMFED (state’s milk cooperative). Recognizing his cattle as valuable assets, he made the wise decision to insure them, hoping to safeguard himself against any potential economic loss from their death. However, his attempt to insure his cattle was met with delays and frustration. Despite paying a hefty premium, he received no response for over a month, and the local official only gave him a verbal confirmation of the policy issuance. When tragedy struck and one of his cattle perished, the process of claiming the insurance became a nightmare. Although the official sent his documents to the insurance company, no communication followed. In desperation, Suresh traveled more than 120 kilometers to Sambalpur to personally visit the insurer’s office, only to find his claim envelope, along with others, left unopened. Sadly, Suresh's experience was not unique, as many other farmers across Odisha were similarly denied the benefits of livestock insurance.

Importance of Livestock Insurance

The livestock sector, also referred to as a sunrise sector, is crucial for income generation for farmers in Odisha- contributing ~14% to Odisha’s agricultural GSVA, and supporting 29 lakh farmers reliant on milk, meat, and eggs produced from cattle, buffaloes, goats, and more. With average agricultural household earnings of just ₹5,112, livestock sector holds the potential to transform the income level of households in Odisha. On the flipside, this raises an important concern that even one animal's loss can cause severe economic hardship for those farmers. In such cases, livestock insurance provides an essential safety net by compensating for losses, reducing financial burdens, and expediting recovery. This risk management tool is especially vital in Odisha, where frequent natural calamities can devastate entire herds rapidly.

Livestock sector serves as an important source of income for many farmers across Odisha

The theoretical foundation for the importance of insurance is supported by decision-making research. Prospect theory explains that risk-averse actors, be it for human or livestock insurance, value the security provided by insurance even if premiums entail a small cost relative to potential losses. Insured farmers are therefore more likely to be entrepreneurial, taking steps to improve their income that they otherwise would not have taken. Thus, well-designed livestock insurance schemes bolster rural financial resilience and augment farmers’ incomes.

Challenges with existing livestock insurance scheme in Odisha

Livestock Insurance in Odisha is implemented by the Odisha Livestock Resources Development Society (OLRDS), operating under the Department of Fisheries and Animal Resources Development (F&ARD). The government subsidised 65% of the farmer’s premium, and early implementation saw scheme uptake targets met with over 80% of intimated claims settled in FY22. However, challenges emerged for all stakeholders – the insurance company, department officials, and the livestock farmers.

1. Insurance Company

The insurance company suffered significant losses due to false claims, creating a trust deficit that resulted in a 40% premium increase between FY22 and FY24. This made Odisha one of the states with the highest one-year policy rates and restricted farmer access to the scheme.

2. Dairy Farmer

As seen in the case of Suresh, farmers had to grapple with slow and non-transparent processes, and could not receive claim amounts even if their cattle were insured. Negative experiences such as Suresh’s discouraged many, and overall scheme uptake fell to less than 50% by FY23.

3.Department Officials

Department officials, especially block officers, faced overwhelming responsibilities. They were tasked with motivating farmers, collecting cash premiums and documentation, and physically forwarding them to district offices. In claim settlements, they also assisted with form filling and document transfers. These cumbersome offline processes reduced morale and limited time for other duties. Lack of visibility over submitted applications left officials struggling to provide clear updates to increasingly frustrated farmers. This mismanagement has not only strained stakeholder relations but also undermined the confidence of farmers in the livestock insurance system.

The solution: The intermediary model for Livestock Insurance

The problem to solve was therefore: how to streamline the current process of the livestock insurance scheme in Odisha? The answer lay in bringing in an incentivised party who would motivate farmers, handle policy and claim documentation, and serve as buffer for quality checks: the insurance intermediary.

What is the insurance intermediary? The insurance intermediary, or broker, is essential in facilitating effective livestock insurance. Think of them like an insurance agent- they explain premium and claims processes, help you fill all forms, facilitate transfer of premium payments, and handle all documentation. They thus bridge the gap between insurers and farmers and streamline administrative tasks. Their support reduces information asymmetry and builds trust, leading to increased policy uptake.

Livestock insurance intermediaries had not been introduced to Odisha before. The LEAP team at Samagra, with support from Gates Foundation, successfully championed the proposal of the state's own insurance scheme with a higher budgetary outlay and inclusion of intermediaries in implementing the insurance scheme. Intermediary agents would provide doorstep service, collect documentation, assist in premium payments to insurers, and track funds and documents, ensuring transparency. Intermediaries have their own digital portals which could be accessed by the Department officials to track the payment and documents at every stage. In exchange, intermediaries earned a fraction of the premium per animal, incentivising them to expand insurance coverage to as many animals as possible.

Intermediaries’ inclusion boosted government confidence, leading to a fivefold increase in the scheme’s budgetary allocation and a revision of annual targets. This in turn gave the insurance company confidence of achieving economies of scale and lowering their costs, and they quoted India’s lowest livestock premium rates. When it came to claim settlement, the requirement of post mortem reports in cases of natural calamities was removed- another first in the country. Improved policy copy delivery to farmers via SMS and offline intermediary agents was also finalised.

Intermediaries were empaneled by OLRDS via an open tender process, and the final intermediaries were selected by the insurance company based on their experience in other states and quality of their tech systems. The changes were welcomed by the officials from the state level to the field level. They would no longer have to handle funds or documentation, and even though they would still have to maintain records, it was made easier with the intermediary portals having live data relating to policy and claim issuance.

Scheme launch and impact

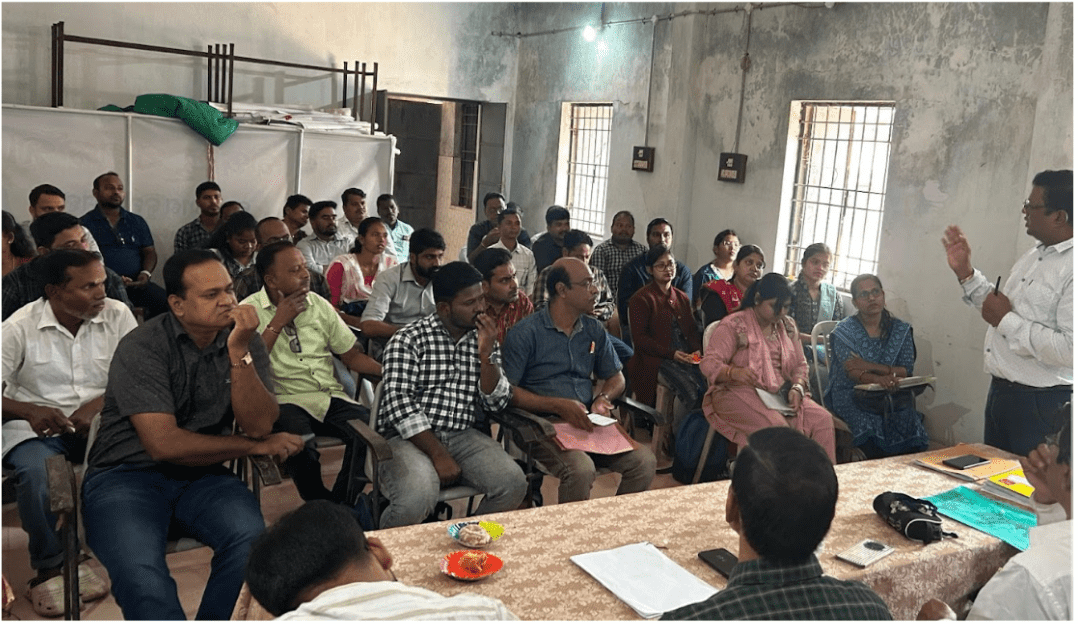

With these changes, Go-Sampad Bima Yojana was formally launched by the state government in late 2024, with the first animal being insured in January 2025. Under the scheme, the state would subsidise 85% of the premium amount, with the farmer having to bear only 15%. As a result,, on average, a farmer would have to make an annual payment of less than ₹200 for insuring one cow,. A state level workshop was also organised in January 2025, to orient district level officials on the scheme’s parameters and on usage of the intermediaries’ portals.

State level workshop on livestock insurance chaired by the Principal Secretary, Department of F&ARD, being conducted

The first animal under Go-Sampad Bima Yojana being insured

However, scheme implementation was not without challenges. Intermediaries were unable to scale up service to all blocks of the state as they did not have enough manpower to service the increased demand, leading to slowness in policy issuance. Additionally, there was a lack of coordination between intermediary agents and the government. officials, leading to confusion on the ground.

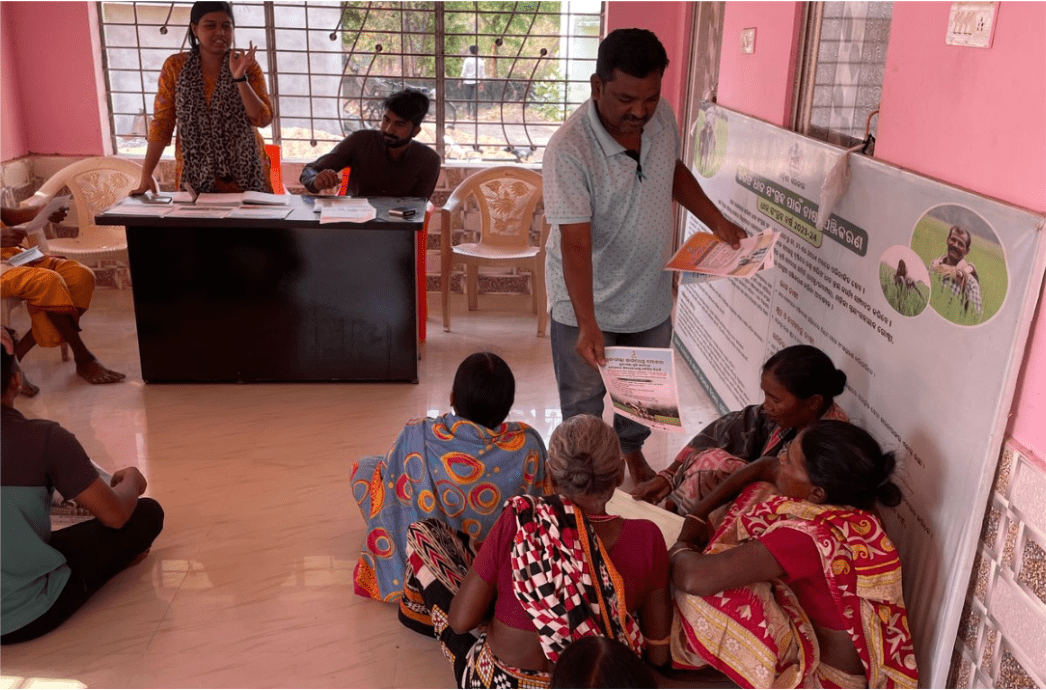

Surveys with over 500 farmers and 100 intermediary agents helped in issue identification. To boost uptake despite limited manpower, govt. officials facilitated camp-based livestock insurance at the Gram Panchayat level. A block-level micro plan covering all 314 blocks in the state was developed, scheduling village camps after consulting field workers and intermediaries. Training of block level officers was also conducted in every district.

Training of block level officers being conducted in Gajapati district

Interactive Voice Response System (IVRS) messages asking livestock farmers to register interest with the Krushi Samrudhhi helpline were sent, to generate concrete leads of cattle owners interested in insuring their cattle. Data-driven cascaded review meetings by senior officials motivated stakeholders, while intermediaries were also encouraged to recruit livestock artificial insemination technicians as part-time agents due to their local connections and expertise.

Sessions being conducted at the village level to increase awareness about the scheme

These measures worked, and the scheme uptake increased to get to over 40% of the year’s target in just 3 months of launch. Policies are now being issued to farmers within 3 days of their documents being submitted, with all records being accessible to officials via portals.

Farmers like Suresh now get their policy document in less than a week of initiating the process for insuring their livestock. They no longer have to chase after officials for the same. Officials do not need to handle any documentation or money, but are able to track all applications in real time. The transparency also helps in rapid claim settlement, and farmers are now able to get settlements within 3 days of the death of their cattle. The scheme has now become an integral part of government systems, appreciated by officials and farmers alike.

Conclusion

Our measures till now reduced delays while rebuilding trust and boosting policy uptake. The coordinated approach we took enhanced risk mitigation at the grassroots level, served as an exemplar of effective public-private partnership, supported farmers’ livelihoods, and strengthened the overall agricultural framework in Odisha.

However, perfecting the process of livestock insurance in the state is an ongoing endeavour. Moving forward, it is imperative to expand the intermediary network and incorporate technological innovations, to support a more robust insurance framework that will eventually help Odisha achieve one of the most sustainable and resilient livestock ecosystems in the country.